Learn how to set up payment pages, change design settings, understand reporting and metrics, and dive into advanced features of Page Builder.

.png?width=750&name=expired%20authorizations%20750x250%20(1).png)

An authorization will remain on a credit card for a period of 3-21 days, depending on the card issuing bank. After the authorization expires, the amount of the authorization is returned to the available balance of the credit card, and the customer is free to use that available balance on a new purchase. It is therefore possible that if you wait too long to settle an authorized charge that the available balance will be insufficient to cover the amount and the settlement will fail. Sometimes a single failed transaction can result in an entire batch failing. It is for this reason that authorizations older than 21 days cannot be settled via the transaction center and must be re-authorized.

If you attempt to settle an authorization older than 21 days, an alert box will show in the transaction center stating:

| This transaction must be reauthorized. It was authorized more then 3 weeks ago and can no longer be settled. Click on the magnifying glass icon to the left of this row to bring up the transactions details. You will be able to rerun this card from there. You must settle transactions within 21 days of them being authorized. |

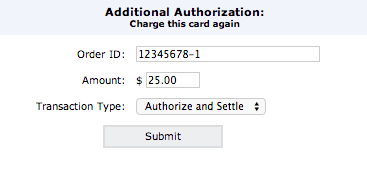

You will need to re-authorize any authorizations older than 21 days.

NOTE: For the Order ID, we recommend that you use the original order ID with a character (such as a 1 or an A) at the end. This way, it is easy to recognize the charge as a re-authorization.

If the re-authorization is declined; you will need to contact your customer to obtain new payment information, as the card no longer has enough available balance to cover the purchase.

NOTE: You are still on the transaction details screen for the original authorization, so you are voiding the original/expired authorization, not the new/re-authorized transaction